True profitability? Equitable overhead allocations?

Whilst working as a Financial Controller, I was often asked to identify our least profitable products and services and analyse why they were poor performers. This gave me quite a headache as the analysis had to be performed off-line using spreadsheets and complex calculations over masses of data which inevitably took forever to reconcile.

Once the analysis was done, I was then asked to drill down into the detail, which was impossible with the tools I had available. It’s fair to say that this was one of my most frustrating tasks.

This was one of my most frustrating tasks.

When I moved into business consulting, I found that this was a very similar story with all of the businesses that I worked with.

The use of SAP’s CO-PA module certainly sped up the analysis and breakdown, but when it came to getting to “true profitability” of a product or service, CO-PA’s limitations became clear to me.

Certainly, the analysis of gross profit by a multitude of characteristics such as customer, product, service type, region, brand, etc. became much easier to reconcilable with the use of SAP CO-PA, but when we tried to allocate indirect costs to the same characteristics, we found that we were skewing the results.

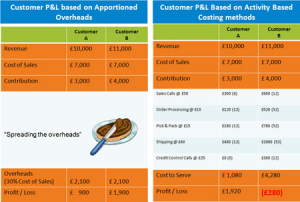

The impact of activity based costing

If you look at the example above, the left hand table shows the results when you are using CO-PA apportionment methods, whereas what you really want to see are the results on the right!

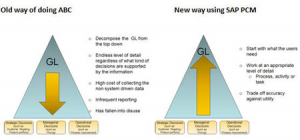

What about the horror stories of trying to implement ABC?

I then came across an activity-based management tool back in the early 2000’s which a client of mine invested a lot of time and effort in implementing.

Unfortunately, this took the guise of a huge black box which no one, excepting the consultant who had designed and implemented it really understood! (I guess many of the readers of this will have had some similar experiences that they try hard to forget).

This meant that the solution quickly fell into disrepute, because no one could reconcile the results thrown out by it and it was very costly to maintain.

Following that experience, I personally decided that ABC had a very poor benefits case due to:

- The nature of the data it required from day one

- The maintenance efforts

- The impossibility of reconciliation of the results

- The length of time it takes to run the allocations on a regular basis

So, what changed MY mind?

When SAP acquired BusinessObjects it included a niche product called Profitability and Cost Management which instantly interested me as a potential solution for this missing functionality.

When I investigated further, it seemed to have answers to the negative points I cited earlier:

- Can work at any level you have the data for, so you can increase complexity as you become more mature in your requirements

- Owned and administered by Finance, with very friendly visual user interface

- Full trace-back of results from source posting through to end allocation

- Real time “in-memory” solution means it can cope easily with large volumes of data.

Can this help with planning for future growth?

Yes! I recently worked with a client to take the closed loop process one step further by using a combination of SAP ERP CO-PA actual data and SAP PCM allocations to clearly and regularly analyse true profitability at a granular level never before available, other than using time consuming manual processes.

Moving forwards, the next step will be to integrate SAP PCM allocations into the planning cycle using “pre-allocation” data from SAP BPC and running it through the SAP PCM model to do the calculations, thus allowing SAP PCM to do what it is good at – calculating large volumes of allocation data, and leaving BPC to concentrate on what it is good at – being a planning tool, not a calculator!