In this blog I will look at how the capabilities of SAP CO-PA to meet the current and future demands for profitability reporting. I will also touch upon its limitations.

During my time as a Financial Controller I was fascinated by the way in which SAP CO-PA provided the ability to analyse profitability (or more correctly, contribution) down to customer and product. It was a very powerful analytical tool within an ERP solution and it definitely sold SAP to me. Then I moved into consulting, and continued to extol the virtues of SAP CO-PA to my clients, but began to see that clients needed even greater granularity, particularly by being able to analyse profitability down below contribution.

SAP CO-PA has various tools within its repertoire to enable some form of profitability analysis.

Highly integrated module provides instant contribution analysis by key characteristics

When you have costing based SAP CO-PA active and configured in your SAP ERP system, as soon as a billing document is posted into your FI ledgers (General Ledger and Accounts Receivable), statistical postings are also made within the SAP CO-PA ledger.

These postings into SAP CO-PA relate purely to the P&L entries and are directly associated with the pricing conditions used within the billing document, so will usually consist of values relating to things like:

- Sales volumes

- Gross Sales value

- Discounts

In addition, where you have pricing conditions which post standard costs of goods sold (from the Product Costing module) to your General ledger at the time of your billing document posting, these can also post to your SAP CO-PA ledger as Costs of Goods Sold, with values such as:

- Variable costs

- Fixed costs

- Direct labour costs

So there is a high degree of integration between SAP CO-PA and your Sales (SD) module, as well as other modules within SAP, which provides a robust analysis solution easily reconciling between your financials and your sales results.

These statistical postings are saved against a combination of characteristic values allowing analysis using basic “slice & dice” reporting.

Standard, pre-delivered characteristics include:

- Customer

- Product

- Customer group

- Division

- Distribution channel

- Sales organisation

- Ship to party

In addition many more characteristics can be defined to meet your specific requirements, provided that their values can be derived from existing data or through defined rules.

This enriches your Revenue and Cost of Sales data significantly from that which is generally available within the General Ledger.

Further values can be calculated within SAP CO-PA such as commission, and a provision for bad debt on individual sales. These values are calculated using rules similar to those used in the Sales module of SAP, where you can define percentages or fixed amounts with reference to other values already posted from the billing document.

As these values are purely available within SAP CO-PA reporting and are not posted within the General Ledger, there is no impact upon your statutory reporting.

Periodic settlement of costs

In addition to revenue and costs being posted into SAP CO-PA in real time at the time of billing, you can also settle other costs which are not directly associated with a billing document (pricing) postings on a periodic basis.

These are also “statistical postings” as the true postings continue to be made in the General Ledger.

These types of settlements can for example:

- Allow you to calculate and report upon Work in Progress for long term contracts.

- Incorporate production process variances into your profitability analysis.

Periodic allocations of indirect costs

Using SAP CO-PA assessment cycles allows you to allocate indirect costs, which are primarily captured on cost centres to characteristics such as product and customer on a periodic basis.

Apportionment methods such as statistical key figures, fixed values and percentage splits can be used

The combination of these different methods can build up your Profit and Loss statement by using different slice/dice combinations which can be a powerful analysis tool, enabling you to analyse your various types of segmental results.

Ability to transfer data to SAP BW

For reporting, as well as being able to report in ERP directly, standard SAP BW extractors and models can easily be enhanced to capture your own defined characteristics and value fields, which provides the ability to use all of the BW reporting tools and also utilise SAP BusinessObjects reporting, with minimal effort.

In addition, this reduces the performance impact of running high volume reports within your OLTP system.

Planning with SAP CO-PA

SAP CO-PA provides some limited basic planning functionality within SAP ERP, however it can provide summary data to seed SAP’s Business Planning and Consolidation (BPC) application. If you have a NetWeaver implementation of SAP’s BPC, then you can take advantage of the ability to utilise the enhanced standard BW extractors and models for SAP CO-PA to feed the SAP BPC planning model.

Summarisation levels

To speed up reporting, user defined summarisation levels can be created.

These summarise certain characteristics which may not need to be reported upon every time, for example, you may not want to always report down to “ship to party”, and so you can exclude that characteristic from the summarisation level, to reduce the number of records to report against.

These tables can be used in both SAP ERP and SAP BW reporting.

You can create and maintain multiple summarisation levels, which allow reports to be pointed at the most appropriate ones for performance purposes.

In addition the facility to “Re-align” the historical data if you want to re-state anything – say moving a customer from one group to another…

SAP CO-PA on HANA

A fairly recent innovation has been the option to harness the SAP HANA platform for CO-PA.

There are currently two main options available on general release:

SAP CO-PA Accelerator

This option uses the SAP HANA appliance as a secondary database for SAP CO-PA.SAP CO-PA data is replicated into the in-memory application which is then read by the CO-PA application within ERP to:

- Execute reports

- Display line items

- Run cost centre assessments to SAP CO-PA

- This is a plug and play solution, which is as non-disruptive to the users as possible.

BI reporting on SAP CO-PA data in HANA

This option takes the data from CO-PA and replicates it within SAP HANA, where it can be accessed via BW for reporting.

There is no access to the HANA data from the CO-PA module in SAP ERP.

SAP Business Suite powered by SAP HANA

Earlier in January 2013, SAP announced the availability of SAP Business Suite powered by SAP HANA becoming available for Business Suite customers.

This is an option which makes the enhanced performance of using the SAP HANA platform for CO-PA available directly within the business suite.

Words of warning

It is often seen that performance can be impacted with large assessment cycles (for the allocation of indirect costs) which have to be run at critical times of the month.

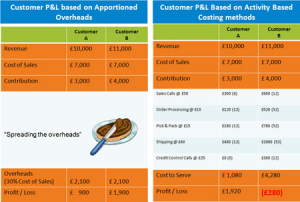

It is important to recognise that you will be using a “spreading” methodology for allocating your indirect costs with CO-PA, rather than the more robust and accurate Activity Based Costing methodology which is used with other tools.

If you take a manufacturing example, although the direct costs captured in the manufacturing process are most likely to be accurate, overall profitability reporting falls down with the capture and allocation of indirect costs/cost to serve is usually simplified, and is largely performed using forms of apportionment (related to Cost of Sales or Revenue for example), which leads to inaccurate results.

This is most likely due to the nature of indirect overheads, which are complex and time consuming to allocate in a more scientific manner.

YES – CO-PA can analyse profit at various levels by customer and product – but it isn’t so good with high volumes of customers or products – for example in the retail space, as its calculation engines are unwieldy within the OLTP environment.This can be overcome to some extent by utilising CO-PA on the HANA platform, especially for the gross margin analysis.

YES – CO-PA can apportion indirect costs to customers and products – by using apportionments based on cost of sales or revenue for example, but this can skew the profitability and it is questionable just how much this adds value.So, to summarise, SAP CO-PA is excellent at being able to provide summary profitability analysis to contribution level, but when you drop below there, you start to lose the accuracy you really need to be able to make business decisions based on it.

Can SAP CO-PA help with future demands for profitability reporting?

The answer to this is an emphatic YES!

SAP CO-PA can capture an enriched set of characteristic values and directly associated revenues and costs at the time of posting a billing document.

Its well documented reporting performance issues with large volumes can be alleviated by utilising the very powerful HANA platform.

SAP HANA can also help with periodic allocation performance, provided your business does not wish to use complex allocation methodologies.

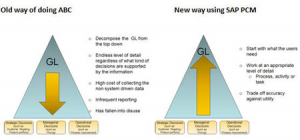

If you consider SAP CO-PA as your initial base data capture for gross margin analysis, you can then complement this along with additional costing and simulation tools such as SAPs Profitability and Cost Management, to provide you with a robust, scalable and intuitive profitability analysis solution.

SAP CO-PA can also provide a great basis for sales planning/forecasting as it will hold many characteristic values which are relevant for sales.